Reverse Factoring / Supplier Finance

Reverse factoring, also known as supply chain financing or supplier finance, is a financial arrangement that allows a buyer to extend its payment terms to suppliers while providing early payment options to the suppliers themselves. It's a form of working capital financing that aims to optimize the cash flow along the entire supply chain.

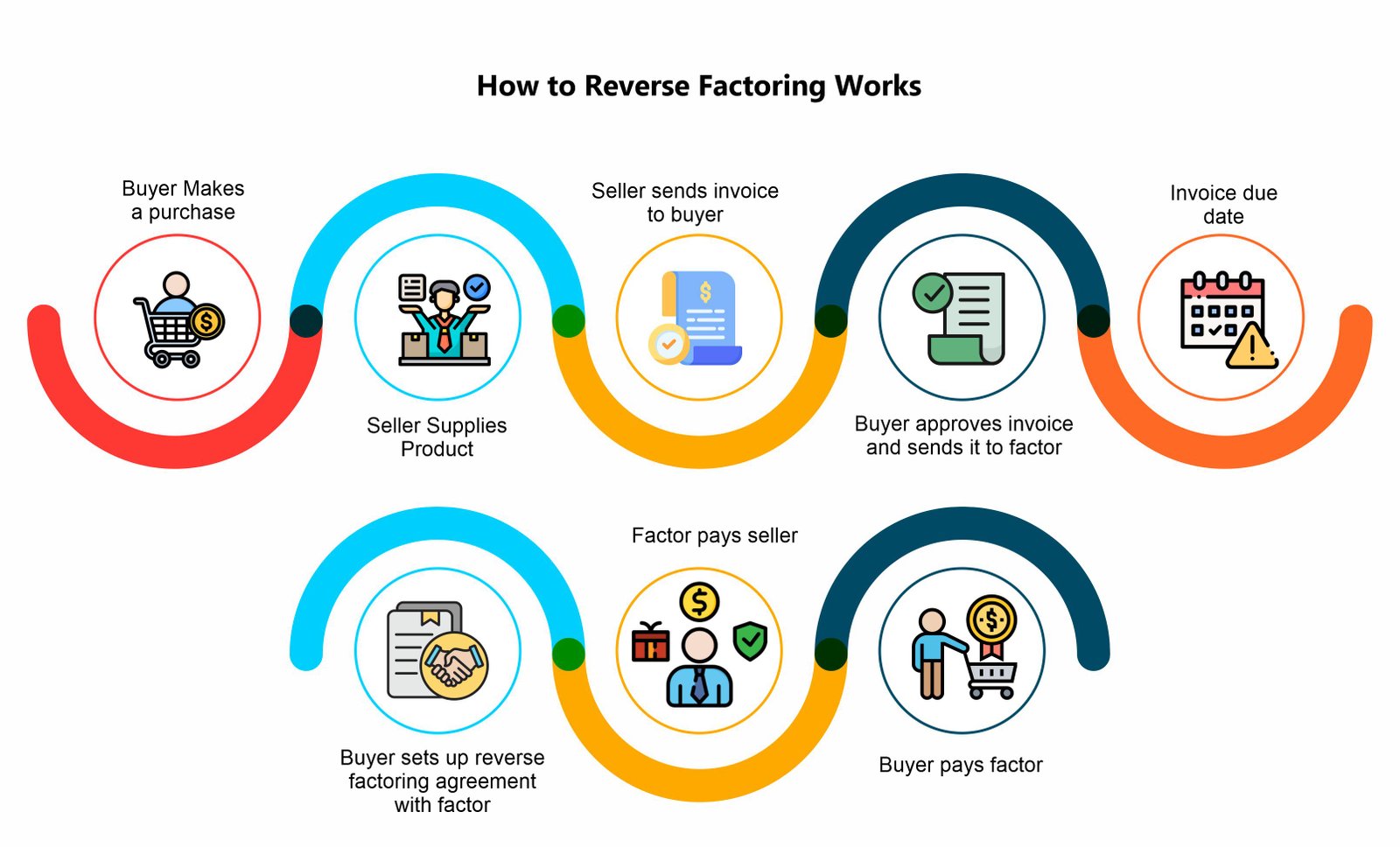

Here's how reverse factoring typically works:

Buyer-Supplier Relationship: A buyer purchases goods or services from its suppliers on credit terms, which means the suppliers issue invoices with payment due at a later date, often ranging from 30 to 90 days.

Financing Agreement: The buyer enters into a reverse factoring agreement with a financial institution, such as a bank or a specialized financing company. This agreement establishes a financing facility that will be used to pay the suppliers' invoices early.

Supplier Enrollment: The buyer invites its suppliers to participate in the reverse factoring program. Suppliers who opt-in agree to receive early payment for their invoices at a discount to the invoice amount.

Invoice Approval and Financing: Once the buyer approves the supplier's invoice for payment, the supplier has the option to request early payment through the reverse factoring facility. The financial institution then advances the payment to the supplier, usually within a few days, deducting a fee or discount from the invoice amount.